Friday, January 26, 2007

On Shaky Ground

Baltimore's arcane system of ground rents, widely viewed as a harmless vestige of colonial law, is increasingly being used by some investors to seize homes or extract large fees from people who often are ignorant of the loosely regulated process, an investigation by The Sun has found.

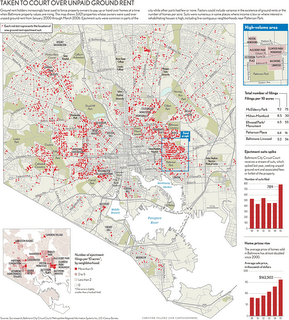

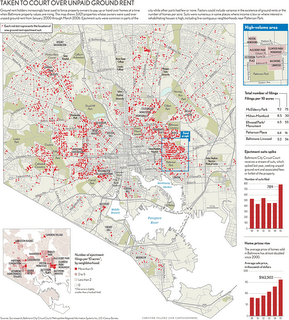

Tens of thousands of Baltimore homeowners must pay rent twice a year on the land under their houses. If they fall behind on the payments, the ground rent holders can sue to seize the houses-- and have done so nearly 4,000 times in the past six years, sometimes over back rent as little as $24, The Sun found.

Advertisement

More than half of the ground rent suits filed in the past six years were brought by entities associated with four groups of individuals and families, court records show.

Most ground rent holders insist that home ownership is rarely put in peril. But Baltimore judges awarded houses to ground rent holders at least 521 times between 2000 and the end of March 2006, The Sun found, analyzing court computer data and studying hundreds of case files to document the trend for the first time. The properties ranged from boarded-up rowhouses to a 7,000-square-foot Victorian in Bolton Hill.

In many cases, ground rent holders used their extraordinary power under state law to oust the owners from their houses and then sold the homes for tens of thousands of dollars in profits. Some homeowners reached settlements to regain their houses, paying legal and other fees many times the amount of ground rent owed, though court records don't make clear how often that happens.

While some of the most aggressive investors have owned ground rents for years, it wasn't until the late 1990s that rising property values in Baltimore City made it attractive to attempt to seize houses. The number of new lawsuits rose 73 percent last year and shows no signs of leveling off.

This activity occurs across Baltimore but has clustered in some areas as they have started to gentrify, including neighborhoods just north of Patterson Park and around Washington Village.

Told of The Sun's findings, outgoing Maryland Attorney General J. Joseph Curran Jr. said he had ordered an immediate investigation, adding that it might be time to phase the system out. "An older couple or a widow could forget this, and for someone to come and take their house, when it's worth so much more than they paid for it, is an outrage," Curran said.

The Sun's investigation also found that:

• In nearly every aspect, the law favors ground rent holders. Homeowners rarely win once a lawsuit is filed. And the longer a case goes on, the more it can cost the homeowner.

• No other private debt collectors in Maryland can obtain rewards so disproportionate to what they are owed. In contrast with a foreclosure, the holder of an overdue ground rent can seize a home, sell it and keep every cent of the proceeds. To prevent a seizure, homeowners almost always have to pay fees that dwarf the amount of rent they owe.

• State law puts the onus on property owners to track down their ground rent owner and make payments, though it's sometimes next to impossible to find that information. No registry of ground rent holders exists, and property deeds typically contain only the barest of details about them.

• Some investors seek out overdue ground rents to purchase, then file lawsuits to take the property built on the land. In some cases, the legal owners of these houses have died, and the law is not clear about whether investors must give relatives a chance to satisfy the debts and keep the homes.

'Business is business'

R. Marc Goldberg is a Baltimore attorney and ground rent owner who acts as a spokesman for about two dozen rent holders, including his family and some of the other investor groups that pursue the most ground rent lawsuits, called "ejectments."

He doesn't dispute that clashes over property ownership occur more often these days as investors scramble to reclaim decrepit parts of Baltimore. But he denies that they exploit the ground rent law or charge excessive fees. Nobody gets in trouble if he pays his rent on time, Goldberg said.

"I'm not looking to put people out and to be mean and nasty," he said. In a series of interviews with The Sun, Goldberg repeatedly used the refrain "Business is business."

"I can't deny an economic incentive to make a windfall profit," he said.

Many investors say that while the returns remain attractive, the business is difficult -- with many challenges in collecting the rent or tracking down owners of vacant houses. They say they deserve to be paid their rent on time -- and that they sue to take homes only after lengthy collection efforts, and because it is their only remedy under the law.

"If you don't pay, you are putting your property at risk," said Lawrence Polakoff, a Baltimore Realtor whose family has filed more than 100 ejectment lawsuits since the start of 2000. "A ground rent owner isn't going to just sit back and say, 'I'm sorry someone's died,' and forget about it."

"You can make a very good living doing this," said Polakoff, adding that the increase in ejectment lawsuits is directly related to rising real estate prices.

Most ground rent holders say they rarely, if ever, try to seize homes. For smaller holders, the cost of pursuing an ejectment can be prohibitive. Some investors are fearful of seizing properties that have lead-based paint or housing code violations. Others say they avoid seizures on principle.

Advertisement

"We would never allow ourselves to be in that position. We are about helping people, not hurting them," said Greg Cantori, executive director of the Marion I. and Henry J. Knott Foundation. The foundation, which supports Catholic charities, owns about 1,600 ground rents but hasn't filed an ejectment lawsuit since 1996.

Landlord Baltimore

Estimates of the number of Baltimore properties subjected to ground rent run as high as 120,000, many of them the familiar red-brick and white-marble-stepped rowhouses.

Ground rents take the form of 99-year leases, renewable forever. All property deeds must note whether there is a ground rent. Rents generally range from $24 to $240 a year; some very old leases are written in shillings.

Their origins can be traced to the summer of 1632, when King Charles I of England gave Cecilius Calvert all the land in what is now Maryland. Calvert, better known as the second Lord Baltimore, did what any self-respecting aristocrat did in those days: He charged rent to the colonists who wanted to build on his soil.

Starting in the early 1900s, developers built miles of rowhouses in Baltimore with ground rents. They saw the system as a progressive way to keep home prices within reach of the working class, because people wouldn't have to buy the land as well as the house.

Charities, foundations, churches, banks and some retirees have held ground rents for years as investments. Investors often buy and sell them from each other, sometimes through classified ads.

More recently, some property owners have created new ground rents -- at rates several times higher than the previous rents -- when they sell a property. This is allowed by the law.

Homeowners, however, have the right under state law to buy out ground rents created after 1884 under specified price formulas and conditions.

Though there are residential ground rents in other areas of the state, including Anne Arundel and Baltimore counties, they are far more common in Baltimore City. While unusual, ground rents exist in other places; for example, much of Hawaii has them.

"We view ground rent as one of the sticks in the bundle of property rights," said Carolyn Cook, deputy executive vice president of the Greater Baltimore Board of Realtors, adding, "For the majority of the people, it doesn't have much of an impact."

Loss and gain

Thelma Parks, 56, lived for more than two decades in Druid Heights, just a few blocks from the boyhood home of the late Supreme Court Justice Thurgood Marshall, until losing her house last year in an ejectment case. It was filed by a trust set up by Fred Nochumowitz, whose relatives have long held ground rents.

Records show that the Nochumowitz trust bought the ground rent on Parks' house in January 2002. Parks couldn't make her payments, which with the fees for the court action came to "about $1,200," she says. With more time, she says, she could have paid off the $1,200.

After taking her property, the trust sold it to an investment company for $70,000 in September 2005. That company resold it about six months later for $128,000. Parks, meanwhile, was forced to rent in another part of town.

"It ruined every one of my plans," said Parks, who works for the federal government. "They all went out the window. ... I'm going to have to work until I fall apart.

"I can't retire," she said. "Everyone is making a profit from it but me."

Geoffrey Forman, the attorney who handled the Parks case for the Nochumowitz trust, said he wouldn't discuss any cases he was involved in. A woman at Fred Nochumowitz's Boca Raton, Fla., residence identifying herself as Mrs. Nochumowitz said her husband wasn't available for comment and that she didn't know when he would be.

Reporters for The Sun witnessed six property seizures stemming from ground rent between early summer and late fall.

Some played out matter-of-factly. Once deputies from the city sheriff's office determined that nobody was home, workers hired by the new owners popped out the door locks and replaced them within minutes. The crew could then empty the house and pile its contents in the street -- so long as cars could get through.

Advertisement

In the 2600 block of Mura Street in the East Baltimore community of Berea, electric candles still shined in the front window of the vacant rowhouse, and an Easter wreath hung on the front door as the ejectment crew arrived on the morning of July 26.

Strewn throughout the rooms were personal mementos, from bowling trophies to religious icons to two ticket stubs from an evening showing of Scary Movie 4 three months previously. The unpaid ground rent was $252, though fees and other costs boosted the bill to $2,118.67.

In three cases, deputies told occupants they had to get out immediately unless they could work out something with the new owners.

On a hot August morning on North Brice Street in the Midtown-Edmondson area, one family lost a rowhouse adjoining the one where it lives. Minutes later, an elderly man told a child about to put his tricycle away in the seized house: "You can't put it in there. It ain't our house no more."

The actions of some ground rent holders upset some traditional investors, such as Cantori of the Knott Foundation.

Cantori says that the foundation relies on the income from ground rent -- about $200,000 a year -- to help pay its operating expenses, but that it is redeeming or selling dozens every year and writing some off as uncollectible.

Property records show that the Knott Foundation -- among other charitable and religious groups -- sold ground rents to investors who filed ejectment lawsuits. It typically has sold those leases for their redemption value under state law -- for example, a $90-a-year rent sold for $1,500.

Cantori calls the rise in ejectment actions and seizures "unconscionable." He says the foundation sold ground rents because they were delinquent and wanted to "get them off the books" after failing to collect the rent through normal procedures. He says he didn't know that the new owners had sued to seize the properties.

From owner to renter

Deloris McNeil still doesn't understand how she went from owner to renter in her West Baltimore house.

Court records give only part of the answer.

Fred Nochumowitz, acting as trustee for some family ground rent holdings, filed suit against McNeil in April 2002, asserting that her ground rent -- $96 a year -- was more than six months behind. McNeil admits that she let the debt slide, but only did so because she was sick. Later, she said, she couldn't afford the legal fees added to her bill, and didn't realize she could lose her house.

McNeil, 59, said she is disabled and suffers from high blood pressure, which she keeps in check by taking seven pills a day. She says she suffered a stroke after her daughter died.

McNeil never tried to defend herself in court, though court records show she was served with legal notice of the suit. She says she couldn't face going to court.

A judge handed over her rowhouse to the Nochumowitz trust. Property records show that the trust sold the house about a year later for $15,000 to Lauren Montillo, who specializes in rehabilitating city properties for resale as rentals.

Montillo, who has bought at least 22 properties from Nochumowitz family interests, says she chose not to rehab the house and evict McNeil, so long as she paid her $550 a month in rent. "I don't have the guts to throw her out," said Montillo. "I have a little bit of a conscience."

Says McNeil, "It would mostly kill me" to move.

McNeil is luckier than others who lost ownership of their homes, but she says she doesn't feel that way.

"Sometimes I feel like screaming at the top of my lungs," McNeil said, seated at her cluttered dining room table, dabbing at tears with a crumpled tissue.

McNeil's loss of her house without a fight is not unusual. The Sun's analysis of court data found that homeowners didn't respond in nearly 60 percent of the ejectment lawsuits in which property changed hands during the past three years.

Advertisement

'Uninformed public'

There's no single explanation for why this happens, according to a review of hundreds of court records and interviews with more than a dozen people facing ejectment.

Some people say they didn't understand the process, especially the severity of the consequences for failing to pay. Some say they couldn't afford an attorney. Others say they hadn't been contacted. A few people who were owners of boarded-up or abandoned properties didn't seem to care about losing them, even when told that they could be sold for thousands of dollars.

Court officials don't know why so few people respond. As a result, they can't tell whether the lack of response is a growing problem or not. "By itself, that doesn't raise any suspicions," said Judge Evelyn Omega Cannon, judge in charge of the civil docket in Baltimore City Circuit Court.

Some lawyers and people sued say that part of the problem is that, even with all the fees added to ground rent bills, it costs more to hire a lawyer than to pay the amount the lawsuit is seeking.

"If they're not eligible for our services and they can't hire a lawyer and they don't know enough to file a letter with the Circuit Court, then it's all over," said Louise Carwell, senior staff attorney in the housing consumer law unit of the Legal Aid Bureau in Baltimore.

Three years ago, after a Towson lawyer complained about an ejectment suit filed against a 93-year-old client, the General Assembly capped a ground rent holder's attorneys' fees for preparing and filing an ejectment lawsuit at $700. But the law also allows ground rent holders to charge the property owner $300 for searching property titles, and pass on all other costs of collecting the debt -- copying, process servers, lawsuit filing fees -- plus up to $500 in costs of recovering back rent for periods before the lawsuit was filed.

The best a homeowner can hope for in most cases is that a judge will approve an installment plan for paying off these fees -- which can be 20 to 50 times the amount of rent owed -- but that happens infrequently.

Reviewing more than 500 case files, The Sun found fewer than a dozen in which homeowners won their cases outright.

"Unfortunately, in many of these cases, you're dealing with an uneducated public and an uninformed public," said former Circuit Judge Thomas E. Noel, who heard numerous ground rent cases before leaving the bench in April.

Even a lawyer who represents ground rent holders says his side has a clear advantage. "The people who file these cases know the law inside and out," said J. Scott Morse. "Other people [homeowners] don't have a clue about it."

It takes a lawyer

Before filing an ejectment lawsuit, a ground rent owner must send a registered letter to the property owner's "last known address" demanding payment. But if there is confusion over the address, or for any other reason the person fails to receive the bill, problems can result.

Linda McGill, a mortgage broker, got into ground rent trouble over a West Baltimore house she had bought for her grandmother, who later died. The relatives living in the house after her grandmother died initially failed to send the ground rent bills to her, she says.

McGill says she discovered that the rent was overdue when the relatives passed a bill on to her husband. An April bill demanded $1,715 -- of which the overdue ground rent was $84. McGill sent the ground rent holder, Houndswood LLC, a check for $84, but Houndswood refused to accept it.

For weeks afterward, McGill says, her calls and letters to Houndswood went unanswered -- until the day before she was scheduled to appear in court. She got a call from longtime Baltimore real estate investor Jack Stollof, a Houndswood consultant who is a founding director of another large ground rent holder, Jack & Harvey Inc. Houndswood filed 522 ejectment lawsuits between January 2000 and November 2006, making it one of the most prolific filers, court records show.

"In the beginning, he was pleasant on the phone," she said of Stollof. "He hinted at $1,500."

McGill had offered $1,050 in the letter she wrote to Houndswood's attorneys in April -- reasonable, she thought, considering the overdue ground rent was $84. But she says Stollof told her that wasn't enough, and that she had no chance in court.

In court the next day, McGill was surprised to hear not only that the bill had grown to $1,837, but also that Houndswood wanted the house -- although that demand had been in the lawsuit. "We're asking for the possession of the property, because the payments have not been made," Herbert Burgunder III, an attorney for Houndswood, told the judge.

"You're in a tough spot because they're acting in accordance with the law, and the law does allow them to impose fees," Circuit Court Judge Joseph H.H. Kaplan told McGill. "How much of the $1,837 can you pay?"

Advertisement

"I agree to pay $900," she responded, no matter that she had offered $1,050 earlier. "To me that's fair."

But the judge asked if she was willing to pay more.

"If you pay $1,500, I will allow you to keep the property," Kaplan said. "Will you?"

Stollof at that point acknowledged the phone call to McGill the day before. "I offered this young lady yesterday the chance to avoid this," he said in court.

McGill wrote a $1,500 check immediately after the hearing.

"For $84, your house can be taken," McGill said after court. "I'm a mortgage broker. Half my clients don't know how to contact their ground rent owners. This is going to take place all day long in Baltimore City, and it does."

Stollof declined to discuss his business when approached after the hearing.

In rare cases, property owners have won ejectment suits by arguing that the ground rent holder did little or nothing to find them.

In October 2003, Brent W. Procida got a call from his banker, telling him he was being sued over $38 in back ground rent. The house in Canton that he owed the rent on was vacant and under renovation; Procida was living five blocks away.

The suit, which demanded $1,615, had been filed in August. But Procida said in court papers that he didn't get a copy of the lawsuit until two days after he got the call from his bank. The ground rent bills had been sent to the vacant house, which is why Procida said he never saw them.

Procida sent a check for $57 to the ground rent holder, Jack & Harvey Inc., to cover the overdue and current rent. Jack & Harvey, however, refused to accept the check because it didn't include the attorneys' and other fees, court records show. Procida said in court papers that he also offered Jack & Harvey $800 to settle the case, to no avail.

Unlike most homeowners taken to court, Procida, a lawyer himself, fought back. He argued in court papers that Jack & Harvey didn't try to look him up in the phone book, which would have taken "approximately 15 seconds," just so it could justify "the exorbitant fees on which it has built its business."

Jack & Harvey argued that it was entitled to all of the fees it sought and had sent notices to Procida's "last known address" as required by the law. Circuit Court Judge Stuart R. Berger ruled in Procida's favor.

Burgunder, who represented Jack & Harvey in the case, declined comment.

Attorneys' fees

The fees in Linda McGill's case are the norm rather than the exception, an examination of hundreds of court files shows.

"The staggering sum of money is the attorneys' fees. It has nothing to do with the ground rent. You only lose your house because the attorney fee is not paid," Noel said. "That's where the problem is."

Noel, the former circuit judge, says he regularly urged settlements when he felt fees were too high. The ground rent system, he says, "should have been investigated 20 years ago."

"Think of how many times judges rendered these judgments in all the courtrooms over all those years," he said. "You're talking about a lot of property. A lot of people were affected by the loss of these houses."

Kim McGavin is an attorney who has advocated ground rent legal reform since a 93-year-old client in a nursing home was sued in an ejectment proceeding.

Advertisement

She and other critics contend that the largest holders tend to do all their legal and title-search work in-house, and can do much of it by computer, making their actual costs minimal.

"Even if you're billing at $200 [an hour], that's three hours, and there's no way it takes that long," she said, referring to the cap of $700 for "reasonable" legal costs. " ... Even if you sent your paralegal to Calvert Street by camel, it's not going to take that long."

Goldberg, the spokesman for the ground rent owners coalition, says ground rent holders must be able to justify the amounts whenever questions are raised.

"I spend $500 in legal fees, a title search, a judgment report and postage before I even send a letter [demanding payment of overdue rent]. A lot of people don't like that. ... Then you get to court and there's that additional level of fees, and people don't like that, either," he said.

"I really don't see [that there is] a problem with gouging. People are never happy to pay a lawyer, especially someone else's lawyer. They should have paid in the first place."

'Land of the undead'

In most cases, homeowners who have mortgages and are subject to ground rent have little to worry about; their payments are made by their lenders from escrow accounts.

Problems can begin when the mortgage is paid off, making the property owner responsible for the rent payments, or when a mortgage is sold by the lender or refinanced, particularly if the new lender is unfamiliar with Maryland's ground rent system.

Ground rent owners typically send homeowners a postcard or form letter every six months as a reminder that it is time to pay. Because there is no uniform style for bills, and they might bear unfamiliar return addresses, they can be easily overlooked by homeowners or dismissed as junk mail, especially by newcomers to Maryland who have never heard of ground rent.

Some ground rent owners use post office boxes or corporate names that can't be found in any telephone directory or don't include a phone number to call. Some never send bills, or they send them directly to the property address, rather than the owner's home address.

Paul Anderson, chief legal review officer for the state Department of Assessments and Taxation, says that homeowners who lose track of a ground rent owner can find themselves in the "land of the undead," unable to either pay the rent or take steps to buy it out.

Noel, the former circuit judge, says he presided over cases in which a mortgage was sold and the new lender stopped paying the ground rent -- unbeknownst to the homeowner. "I'm not suggesting it was anything nefarious. They may not have known who to pay the ground rent to," he said. "The new company had collected this sum of money and they didn't know what the hell to do with it."

Mortgage companies acknowledge that it takes extra vigilance to stay on top of ground rents.

"When a Maryland loan comes in, we identify if there's a ground rent," said Bob Smiley, executive vice president of U.S. Bank Home Mortgage in Owensboro, Ky., which services about 8,500 Maryland loans -- about 1,000 with ground rents. "If you don't, it spirals out of control real quickly."

New rents bloom

Lauren Montillo and another Baltimore rehabber, Petar Pecovic of Touch of Class Properties LLC, have found seizures to be sources of inexpensive housing for their rehab businesses. Each has purchased about two dozen properties from the Nochumowitz businesses, property records show.

Montillo says she feels for people such as her tenant Deloris McNeil. "It's pretty bad what they [ground rent holders] are allowed to do," she said. "The average person can't afford it. How can they come up with four grand?"

Pecovic says he thinks the system has outlived its usefulness. "People losing their houses like this, it's terrible," he said. "Their families have worked for years for these houses."

Even so, he sometimes creates new ground rents -- at $240 a year -- on the properties he fixes up and sells.

"The ground rent business is a great business," Pecovic said. "You just have to be ruthless."

Baltimore's arcane system of ground rents, widely viewed as a harmless vestige of colonial law, is increasingly being used by some investors to seize homes or extract large fees from people who often are ignorant of the loosely regulated process, an investigation by The Sun has found.

Tens of thousands of Baltimore homeowners must pay rent twice a year on the land under their houses. If they fall behind on the payments, the ground rent holders can sue to seize the houses-- and have done so nearly 4,000 times in the past six years, sometimes over back rent as little as $24, The Sun found.

Advertisement

More than half of the ground rent suits filed in the past six years were brought by entities associated with four groups of individuals and families, court records show.

Most ground rent holders insist that home ownership is rarely put in peril. But Baltimore judges awarded houses to ground rent holders at least 521 times between 2000 and the end of March 2006, The Sun found, analyzing court computer data and studying hundreds of case files to document the trend for the first time. The properties ranged from boarded-up rowhouses to a 7,000-square-foot Victorian in Bolton Hill.

In many cases, ground rent holders used their extraordinary power under state law to oust the owners from their houses and then sold the homes for tens of thousands of dollars in profits. Some homeowners reached settlements to regain their houses, paying legal and other fees many times the amount of ground rent owed, though court records don't make clear how often that happens.

While some of the most aggressive investors have owned ground rents for years, it wasn't until the late 1990s that rising property values in Baltimore City made it attractive to attempt to seize houses. The number of new lawsuits rose 73 percent last year and shows no signs of leveling off.

This activity occurs across Baltimore but has clustered in some areas as they have started to gentrify, including neighborhoods just north of Patterson Park and around Washington Village.

Told of The Sun's findings, outgoing Maryland Attorney General J. Joseph Curran Jr. said he had ordered an immediate investigation, adding that it might be time to phase the system out. "An older couple or a widow could forget this, and for someone to come and take their house, when it's worth so much more than they paid for it, is an outrage," Curran said.

The Sun's investigation also found that:

• In nearly every aspect, the law favors ground rent holders. Homeowners rarely win once a lawsuit is filed. And the longer a case goes on, the more it can cost the homeowner.

• No other private debt collectors in Maryland can obtain rewards so disproportionate to what they are owed. In contrast with a foreclosure, the holder of an overdue ground rent can seize a home, sell it and keep every cent of the proceeds. To prevent a seizure, homeowners almost always have to pay fees that dwarf the amount of rent they owe.

• State law puts the onus on property owners to track down their ground rent owner and make payments, though it's sometimes next to impossible to find that information. No registry of ground rent holders exists, and property deeds typically contain only the barest of details about them.

• Some investors seek out overdue ground rents to purchase, then file lawsuits to take the property built on the land. In some cases, the legal owners of these houses have died, and the law is not clear about whether investors must give relatives a chance to satisfy the debts and keep the homes.

'Business is business'

R. Marc Goldberg is a Baltimore attorney and ground rent owner who acts as a spokesman for about two dozen rent holders, including his family and some of the other investor groups that pursue the most ground rent lawsuits, called "ejectments."

He doesn't dispute that clashes over property ownership occur more often these days as investors scramble to reclaim decrepit parts of Baltimore. But he denies that they exploit the ground rent law or charge excessive fees. Nobody gets in trouble if he pays his rent on time, Goldberg said.

"I'm not looking to put people out and to be mean and nasty," he said. In a series of interviews with The Sun, Goldberg repeatedly used the refrain "Business is business."

"I can't deny an economic incentive to make a windfall profit," he said.

Many investors say that while the returns remain attractive, the business is difficult -- with many challenges in collecting the rent or tracking down owners of vacant houses. They say they deserve to be paid their rent on time -- and that they sue to take homes only after lengthy collection efforts, and because it is their only remedy under the law.

"If you don't pay, you are putting your property at risk," said Lawrence Polakoff, a Baltimore Realtor whose family has filed more than 100 ejectment lawsuits since the start of 2000. "A ground rent owner isn't going to just sit back and say, 'I'm sorry someone's died,' and forget about it."

"You can make a very good living doing this," said Polakoff, adding that the increase in ejectment lawsuits is directly related to rising real estate prices.

Most ground rent holders say they rarely, if ever, try to seize homes. For smaller holders, the cost of pursuing an ejectment can be prohibitive. Some investors are fearful of seizing properties that have lead-based paint or housing code violations. Others say they avoid seizures on principle.

Advertisement

"We would never allow ourselves to be in that position. We are about helping people, not hurting them," said Greg Cantori, executive director of the Marion I. and Henry J. Knott Foundation. The foundation, which supports Catholic charities, owns about 1,600 ground rents but hasn't filed an ejectment lawsuit since 1996.

Landlord Baltimore

Estimates of the number of Baltimore properties subjected to ground rent run as high as 120,000, many of them the familiar red-brick and white-marble-stepped rowhouses.

Ground rents take the form of 99-year leases, renewable forever. All property deeds must note whether there is a ground rent. Rents generally range from $24 to $240 a year; some very old leases are written in shillings.

Their origins can be traced to the summer of 1632, when King Charles I of England gave Cecilius Calvert all the land in what is now Maryland. Calvert, better known as the second Lord Baltimore, did what any self-respecting aristocrat did in those days: He charged rent to the colonists who wanted to build on his soil.

Starting in the early 1900s, developers built miles of rowhouses in Baltimore with ground rents. They saw the system as a progressive way to keep home prices within reach of the working class, because people wouldn't have to buy the land as well as the house.

Charities, foundations, churches, banks and some retirees have held ground rents for years as investments. Investors often buy and sell them from each other, sometimes through classified ads.

More recently, some property owners have created new ground rents -- at rates several times higher than the previous rents -- when they sell a property. This is allowed by the law.

Homeowners, however, have the right under state law to buy out ground rents created after 1884 under specified price formulas and conditions.

Though there are residential ground rents in other areas of the state, including Anne Arundel and Baltimore counties, they are far more common in Baltimore City. While unusual, ground rents exist in other places; for example, much of Hawaii has them.

"We view ground rent as one of the sticks in the bundle of property rights," said Carolyn Cook, deputy executive vice president of the Greater Baltimore Board of Realtors, adding, "For the majority of the people, it doesn't have much of an impact."

Loss and gain

Thelma Parks, 56, lived for more than two decades in Druid Heights, just a few blocks from the boyhood home of the late Supreme Court Justice Thurgood Marshall, until losing her house last year in an ejectment case. It was filed by a trust set up by Fred Nochumowitz, whose relatives have long held ground rents.

Records show that the Nochumowitz trust bought the ground rent on Parks' house in January 2002. Parks couldn't make her payments, which with the fees for the court action came to "about $1,200," she says. With more time, she says, she could have paid off the $1,200.

After taking her property, the trust sold it to an investment company for $70,000 in September 2005. That company resold it about six months later for $128,000. Parks, meanwhile, was forced to rent in another part of town.

"It ruined every one of my plans," said Parks, who works for the federal government. "They all went out the window. ... I'm going to have to work until I fall apart.

"I can't retire," she said. "Everyone is making a profit from it but me."

Geoffrey Forman, the attorney who handled the Parks case for the Nochumowitz trust, said he wouldn't discuss any cases he was involved in. A woman at Fred Nochumowitz's Boca Raton, Fla., residence identifying herself as Mrs. Nochumowitz said her husband wasn't available for comment and that she didn't know when he would be.

Reporters for The Sun witnessed six property seizures stemming from ground rent between early summer and late fall.

Some played out matter-of-factly. Once deputies from the city sheriff's office determined that nobody was home, workers hired by the new owners popped out the door locks and replaced them within minutes. The crew could then empty the house and pile its contents in the street -- so long as cars could get through.

Advertisement

In the 2600 block of Mura Street in the East Baltimore community of Berea, electric candles still shined in the front window of the vacant rowhouse, and an Easter wreath hung on the front door as the ejectment crew arrived on the morning of July 26.

Strewn throughout the rooms were personal mementos, from bowling trophies to religious icons to two ticket stubs from an evening showing of Scary Movie 4 three months previously. The unpaid ground rent was $252, though fees and other costs boosted the bill to $2,118.67.

In three cases, deputies told occupants they had to get out immediately unless they could work out something with the new owners.

On a hot August morning on North Brice Street in the Midtown-Edmondson area, one family lost a rowhouse adjoining the one where it lives. Minutes later, an elderly man told a child about to put his tricycle away in the seized house: "You can't put it in there. It ain't our house no more."

The actions of some ground rent holders upset some traditional investors, such as Cantori of the Knott Foundation.

Cantori says that the foundation relies on the income from ground rent -- about $200,000 a year -- to help pay its operating expenses, but that it is redeeming or selling dozens every year and writing some off as uncollectible.

Property records show that the Knott Foundation -- among other charitable and religious groups -- sold ground rents to investors who filed ejectment lawsuits. It typically has sold those leases for their redemption value under state law -- for example, a $90-a-year rent sold for $1,500.

Cantori calls the rise in ejectment actions and seizures "unconscionable." He says the foundation sold ground rents because they were delinquent and wanted to "get them off the books" after failing to collect the rent through normal procedures. He says he didn't know that the new owners had sued to seize the properties.

From owner to renter

Deloris McNeil still doesn't understand how she went from owner to renter in her West Baltimore house.

Court records give only part of the answer.

Fred Nochumowitz, acting as trustee for some family ground rent holdings, filed suit against McNeil in April 2002, asserting that her ground rent -- $96 a year -- was more than six months behind. McNeil admits that she let the debt slide, but only did so because she was sick. Later, she said, she couldn't afford the legal fees added to her bill, and didn't realize she could lose her house.

McNeil, 59, said she is disabled and suffers from high blood pressure, which she keeps in check by taking seven pills a day. She says she suffered a stroke after her daughter died.

McNeil never tried to defend herself in court, though court records show she was served with legal notice of the suit. She says she couldn't face going to court.

A judge handed over her rowhouse to the Nochumowitz trust. Property records show that the trust sold the house about a year later for $15,000 to Lauren Montillo, who specializes in rehabilitating city properties for resale as rentals.

Montillo, who has bought at least 22 properties from Nochumowitz family interests, says she chose not to rehab the house and evict McNeil, so long as she paid her $550 a month in rent. "I don't have the guts to throw her out," said Montillo. "I have a little bit of a conscience."

Says McNeil, "It would mostly kill me" to move.

McNeil is luckier than others who lost ownership of their homes, but she says she doesn't feel that way.

"Sometimes I feel like screaming at the top of my lungs," McNeil said, seated at her cluttered dining room table, dabbing at tears with a crumpled tissue.

McNeil's loss of her house without a fight is not unusual. The Sun's analysis of court data found that homeowners didn't respond in nearly 60 percent of the ejectment lawsuits in which property changed hands during the past three years.

Advertisement

'Uninformed public'

There's no single explanation for why this happens, according to a review of hundreds of court records and interviews with more than a dozen people facing ejectment.

Some people say they didn't understand the process, especially the severity of the consequences for failing to pay. Some say they couldn't afford an attorney. Others say they hadn't been contacted. A few people who were owners of boarded-up or abandoned properties didn't seem to care about losing them, even when told that they could be sold for thousands of dollars.

Court officials don't know why so few people respond. As a result, they can't tell whether the lack of response is a growing problem or not. "By itself, that doesn't raise any suspicions," said Judge Evelyn Omega Cannon, judge in charge of the civil docket in Baltimore City Circuit Court.

Some lawyers and people sued say that part of the problem is that, even with all the fees added to ground rent bills, it costs more to hire a lawyer than to pay the amount the lawsuit is seeking.

"If they're not eligible for our services and they can't hire a lawyer and they don't know enough to file a letter with the Circuit Court, then it's all over," said Louise Carwell, senior staff attorney in the housing consumer law unit of the Legal Aid Bureau in Baltimore.

Three years ago, after a Towson lawyer complained about an ejectment suit filed against a 93-year-old client, the General Assembly capped a ground rent holder's attorneys' fees for preparing and filing an ejectment lawsuit at $700. But the law also allows ground rent holders to charge the property owner $300 for searching property titles, and pass on all other costs of collecting the debt -- copying, process servers, lawsuit filing fees -- plus up to $500 in costs of recovering back rent for periods before the lawsuit was filed.

The best a homeowner can hope for in most cases is that a judge will approve an installment plan for paying off these fees -- which can be 20 to 50 times the amount of rent owed -- but that happens infrequently.

Reviewing more than 500 case files, The Sun found fewer than a dozen in which homeowners won their cases outright.

"Unfortunately, in many of these cases, you're dealing with an uneducated public and an uninformed public," said former Circuit Judge Thomas E. Noel, who heard numerous ground rent cases before leaving the bench in April.

Even a lawyer who represents ground rent holders says his side has a clear advantage. "The people who file these cases know the law inside and out," said J. Scott Morse. "Other people [homeowners] don't have a clue about it."

It takes a lawyer

Before filing an ejectment lawsuit, a ground rent owner must send a registered letter to the property owner's "last known address" demanding payment. But if there is confusion over the address, or for any other reason the person fails to receive the bill, problems can result.

Linda McGill, a mortgage broker, got into ground rent trouble over a West Baltimore house she had bought for her grandmother, who later died. The relatives living in the house after her grandmother died initially failed to send the ground rent bills to her, she says.

McGill says she discovered that the rent was overdue when the relatives passed a bill on to her husband. An April bill demanded $1,715 -- of which the overdue ground rent was $84. McGill sent the ground rent holder, Houndswood LLC, a check for $84, but Houndswood refused to accept it.

For weeks afterward, McGill says, her calls and letters to Houndswood went unanswered -- until the day before she was scheduled to appear in court. She got a call from longtime Baltimore real estate investor Jack Stollof, a Houndswood consultant who is a founding director of another large ground rent holder, Jack & Harvey Inc. Houndswood filed 522 ejectment lawsuits between January 2000 and November 2006, making it one of the most prolific filers, court records show.

"In the beginning, he was pleasant on the phone," she said of Stollof. "He hinted at $1,500."

McGill had offered $1,050 in the letter she wrote to Houndswood's attorneys in April -- reasonable, she thought, considering the overdue ground rent was $84. But she says Stollof told her that wasn't enough, and that she had no chance in court.

In court the next day, McGill was surprised to hear not only that the bill had grown to $1,837, but also that Houndswood wanted the house -- although that demand had been in the lawsuit. "We're asking for the possession of the property, because the payments have not been made," Herbert Burgunder III, an attorney for Houndswood, told the judge.

"You're in a tough spot because they're acting in accordance with the law, and the law does allow them to impose fees," Circuit Court Judge Joseph H.H. Kaplan told McGill. "How much of the $1,837 can you pay?"

Advertisement

"I agree to pay $900," she responded, no matter that she had offered $1,050 earlier. "To me that's fair."

But the judge asked if she was willing to pay more.

"If you pay $1,500, I will allow you to keep the property," Kaplan said. "Will you?"

Stollof at that point acknowledged the phone call to McGill the day before. "I offered this young lady yesterday the chance to avoid this," he said in court.

McGill wrote a $1,500 check immediately after the hearing.

"For $84, your house can be taken," McGill said after court. "I'm a mortgage broker. Half my clients don't know how to contact their ground rent owners. This is going to take place all day long in Baltimore City, and it does."

Stollof declined to discuss his business when approached after the hearing.

In rare cases, property owners have won ejectment suits by arguing that the ground rent holder did little or nothing to find them.

In October 2003, Brent W. Procida got a call from his banker, telling him he was being sued over $38 in back ground rent. The house in Canton that he owed the rent on was vacant and under renovation; Procida was living five blocks away.

The suit, which demanded $1,615, had been filed in August. But Procida said in court papers that he didn't get a copy of the lawsuit until two days after he got the call from his bank. The ground rent bills had been sent to the vacant house, which is why Procida said he never saw them.

Procida sent a check for $57 to the ground rent holder, Jack & Harvey Inc., to cover the overdue and current rent. Jack & Harvey, however, refused to accept the check because it didn't include the attorneys' and other fees, court records show. Procida said in court papers that he also offered Jack & Harvey $800 to settle the case, to no avail.

Unlike most homeowners taken to court, Procida, a lawyer himself, fought back. He argued in court papers that Jack & Harvey didn't try to look him up in the phone book, which would have taken "approximately 15 seconds," just so it could justify "the exorbitant fees on which it has built its business."

Jack & Harvey argued that it was entitled to all of the fees it sought and had sent notices to Procida's "last known address" as required by the law. Circuit Court Judge Stuart R. Berger ruled in Procida's favor.

Burgunder, who represented Jack & Harvey in the case, declined comment.

Attorneys' fees

The fees in Linda McGill's case are the norm rather than the exception, an examination of hundreds of court files shows.

"The staggering sum of money is the attorneys' fees. It has nothing to do with the ground rent. You only lose your house because the attorney fee is not paid," Noel said. "That's where the problem is."

Noel, the former circuit judge, says he regularly urged settlements when he felt fees were too high. The ground rent system, he says, "should have been investigated 20 years ago."

"Think of how many times judges rendered these judgments in all the courtrooms over all those years," he said. "You're talking about a lot of property. A lot of people were affected by the loss of these houses."

Kim McGavin is an attorney who has advocated ground rent legal reform since a 93-year-old client in a nursing home was sued in an ejectment proceeding.

Advertisement

She and other critics contend that the largest holders tend to do all their legal and title-search work in-house, and can do much of it by computer, making their actual costs minimal.

"Even if you're billing at $200 [an hour], that's three hours, and there's no way it takes that long," she said, referring to the cap of $700 for "reasonable" legal costs. " ... Even if you sent your paralegal to Calvert Street by camel, it's not going to take that long."

Goldberg, the spokesman for the ground rent owners coalition, says ground rent holders must be able to justify the amounts whenever questions are raised.

"I spend $500 in legal fees, a title search, a judgment report and postage before I even send a letter [demanding payment of overdue rent]. A lot of people don't like that. ... Then you get to court and there's that additional level of fees, and people don't like that, either," he said.

"I really don't see [that there is] a problem with gouging. People are never happy to pay a lawyer, especially someone else's lawyer. They should have paid in the first place."

'Land of the undead'

In most cases, homeowners who have mortgages and are subject to ground rent have little to worry about; their payments are made by their lenders from escrow accounts.

Problems can begin when the mortgage is paid off, making the property owner responsible for the rent payments, or when a mortgage is sold by the lender or refinanced, particularly if the new lender is unfamiliar with Maryland's ground rent system.

Ground rent owners typically send homeowners a postcard or form letter every six months as a reminder that it is time to pay. Because there is no uniform style for bills, and they might bear unfamiliar return addresses, they can be easily overlooked by homeowners or dismissed as junk mail, especially by newcomers to Maryland who have never heard of ground rent.

Some ground rent owners use post office boxes or corporate names that can't be found in any telephone directory or don't include a phone number to call. Some never send bills, or they send them directly to the property address, rather than the owner's home address.

Paul Anderson, chief legal review officer for the state Department of Assessments and Taxation, says that homeowners who lose track of a ground rent owner can find themselves in the "land of the undead," unable to either pay the rent or take steps to buy it out.

Noel, the former circuit judge, says he presided over cases in which a mortgage was sold and the new lender stopped paying the ground rent -- unbeknownst to the homeowner. "I'm not suggesting it was anything nefarious. They may not have known who to pay the ground rent to," he said. "The new company had collected this sum of money and they didn't know what the hell to do with it."

Mortgage companies acknowledge that it takes extra vigilance to stay on top of ground rents.

"When a Maryland loan comes in, we identify if there's a ground rent," said Bob Smiley, executive vice president of U.S. Bank Home Mortgage in Owensboro, Ky., which services about 8,500 Maryland loans -- about 1,000 with ground rents. "If you don't, it spirals out of control real quickly."

New rents bloom

Lauren Montillo and another Baltimore rehabber, Petar Pecovic of Touch of Class Properties LLC, have found seizures to be sources of inexpensive housing for their rehab businesses. Each has purchased about two dozen properties from the Nochumowitz businesses, property records show.

Montillo says she feels for people such as her tenant Deloris McNeil. "It's pretty bad what they [ground rent holders] are allowed to do," she said. "The average person can't afford it. How can they come up with four grand?"

Pecovic says he thinks the system has outlived its usefulness. "People losing their houses like this, it's terrible," he said. "Their families have worked for years for these houses."

Even so, he sometimes creates new ground rents -- at $240 a year -- on the properties he fixes up and sells.

"The ground rent business is a great business," Pecovic said. "You just have to be ruthless."